Especially during these tumultuous times, owners need to regularly monitor the financial health of their business to see what their records are telling them.

Financial statements allow entrepreneurs to see how the company is performing amid the disruptions in the market. This data enables them to forecast possible issues, make informed decisions, and, more importantly, gain better control of their business.

Unfortunately, not all business owners are numbers people. Many find it overwhelming just by looking at their numbers. And that’s what we’re here for – to help entrepreneurs get a better understanding of their numbers.

Getting to Know Your Balance Sheet

Every business must complete three primary financial statements: profit and loss (also called income statement), cash flow statement, and balance sheet. To utilise these reports, you need to know what each stands for. And how to use the information in your business.

In this article, we’ll cover the crucial points that you need to know about your balance sheet – what it is, what’s in it, what it tells you, and more.

What is a balance sheet?

As mentioned, the balance sheet is one of the primary financial statements. It is also called a statement of financial position, used to track a business’s earnings and spending.

It tells the owners and investors what the company owns (assets), what it owes (liabilities) and what is left (equity). Think of the balance sheet as a snapshot of the business’s financial standing at a certain point in time.

What is in the balance sheet?

The balance sheet is divided into three parts: Assets, Liabilities, and Owner’s Equity.

1. Assets refer to the items that the business owns that have a dollar value. Examples are cash in the bank, accounts receivable, inventory, and computer equipment.

Assets are classified into two categories: current assets and fixed assets.

Current assets are items such as cash in the bank, inventory, and accounts receivables. In short, these are liquid assets that you can convert into money in a short amount of time.

On the other hand, fixed assets (also known as long-term assets) have value but can’t be converted into cash in a short time frame. Examples of fixed assets are land & building, furniture, vehicles, and computer equipment.

2. Liabilities represent what the business owes to others. Examples of liabilities are accounts payable, loans and taxes owed.

Like assets, liabilities can also be divided into two categories – current liabilities and long-term liabilities.

Current or short-term liabilities are the obligations of the business that are payable within a year. These items are the area of focus as a company must ensure that it has sufficient assets to cover these liabilities when they are due. Examples of current liabilities are short-term loans, accounts payable, and bank overdrafts.

Long-term liabilities refer to the company’s financial obligations that are not due within a year. An example would be a long-term mortgage that isn’t payable in full in the next 12 months.

3. Finally, owner’s equity represents the company’s money and shows what belongs to the owners. Examples include owners’ equity, share capital, and retained earnings.

Looking at the Balance Sheet

By comparing your current balance sheet with the previous ones, you can identify trends and determine the future direction of the business. You can answer questions like:

- Have you acquired more assets or accrued more debt?

- What were your investments in the current period?

- Are you able to keep your liabilities under control?

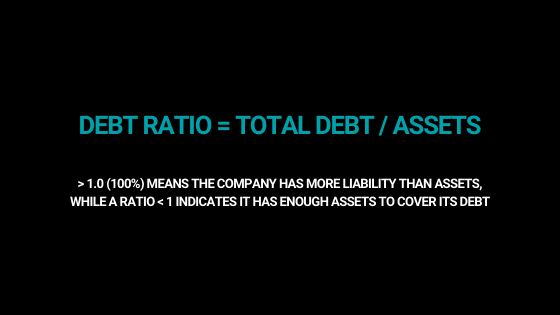

With the data from the balance sheet, you can also calculate fundamental financial ratios to track the performance of your business. For example, you can derive from your balance sheet the debt ratio, which measures the business’s financial leverage.

If you’re looking to apply for a loan, investors and lenders will be interested in taking a look at your financial reports. Or, if you’re putting your business up for sale, buyers would need to know the value of your business and its financial standing, so a balance sheet and other financial reports are required.

Along with the other financial statements, the balance sheet provides essential information to owners and stakeholders about the company’s financial position and profitability. Reviewing these reports at least every month will help you stay on top of your finances and ensure that your business remains thriving.

Need help understanding your financial reports? Let’s talk numbers!