Fact: Inadequate cash flow is one of the top reasons why SMEs in Australia go into insolvency.

Naturally, most entrepreneurs would keep a close eye on profits as it is the key objective of most businesses. However, keeping a business thriving is not just about making a profit; it’s also ensuring that you have a healthy cash flow coming in and out of your business.

It’s possible for your business to be profitable but have no cash. An example of this would be: You make a sale, and you collect the payment within 60 days, but your suppliers expect you to pay them every 30 days for you to continue making products. What this means is that you don’t have the cash yet to settle your due payments to your vendors from the sale you made.

Having adequate cash flow will ensure that you can meet your financial obligations on time– be it payments to your vendors, payroll or other operational expenses.

While profit is indicative of the success of a business, cash flow will keep it operating on a day-to-day basis. Now the question is, how can small companies improve their cash flow?

5 Actionable Steps to Improving Cash Flow

1. Start with Forecasting

A good start would be to project your inflows and outflows to improve your business’s cash flow. Preparing a cash flow forecast will help you get a sense of your cash movements– you can then adjust where needed to meet your financial obligations.

Consider investing in cloud-based accounting software where you can capture all the correct data so you can track your cash and correctly forecast your cash flow.

(Also read: Golden Rules of Cash Flow Forecasting)

2. Apply for a Business Line of Credit

In these times of uncertainty, it’s always helpful to have a “just in case” fund in the form of a line of credit (LOC). An LOC is similar to a credit card, where lenders (like banks) grant you access to capital, which you can draw from precisely when you require it.

Compared to a loan, a line of credit is a flexible form of financing that allows you to borrow what your company needs.

3. Keep a Close Eye on Your Accounts Receivable

If you offer credit to your customers, you need to keep track of your receivables. Customers who are slow to pay can significantly impact your cash flow, so you want to make sure you are paid on time.

Regularly look into your accounts receivable aging report and make sure to follow up with customers who have outstanding invoices to settle.

You can invest in invoice software, where you can bill clients after completing a job and automatically send payment reminders.

4. Negotiate Extended Payment Terms with Vendors

This is particularly helpful if your cash flow is suffering because you have no wiggle room in your payment terms with your suppliers.

Reach out to your vendors and try to ask them if they can extend your payment terms so that you will have more time to sell the product before your payment with them is due.

Another option will be to ask for an early payment discount which will benefit you because you will be paying a lower than the usual rate.

5. Get Professional Help

If you are a small business owner, chances are you are already wearing too many hats, and you don’t have the time (or expertise) to deep dive and understand your company’s cash flow.

A sensible option is employing a numbers wiz as part of your team. For most small companies or startups, hiring a full-time employee isn’t an option. In this case, you can look into outsourcing your finance function to a Virtual CFO to get help where you need support.

With a VCFO in your leadership team, you can access a professional that will help you improve your cash flow and other accounting and finance needs.

Cloud CFO offers customised services specifically for small businesses and startups. We go beyond compliance and transactional work – we help you plan for the future, achieve your goals and make a difference. Get in touch with us today.

💡 Terms to Remember:

- Cash Flow: it is the net amount of money going in and out of your business at any given time

- Positive Cash Flow: indicates that a company is adding to its cash reserves

- Negative Cash Flow: demonstrates that a company has more outgoing than incoming cash

- Cash Flow Statement: it is a financial report that provides information about cash generated from general operations alongside money raised or used for financing and investing activities

- Cash Flow Forecast: it is a way of estimating the flow of money going in and out of your business over a certain period

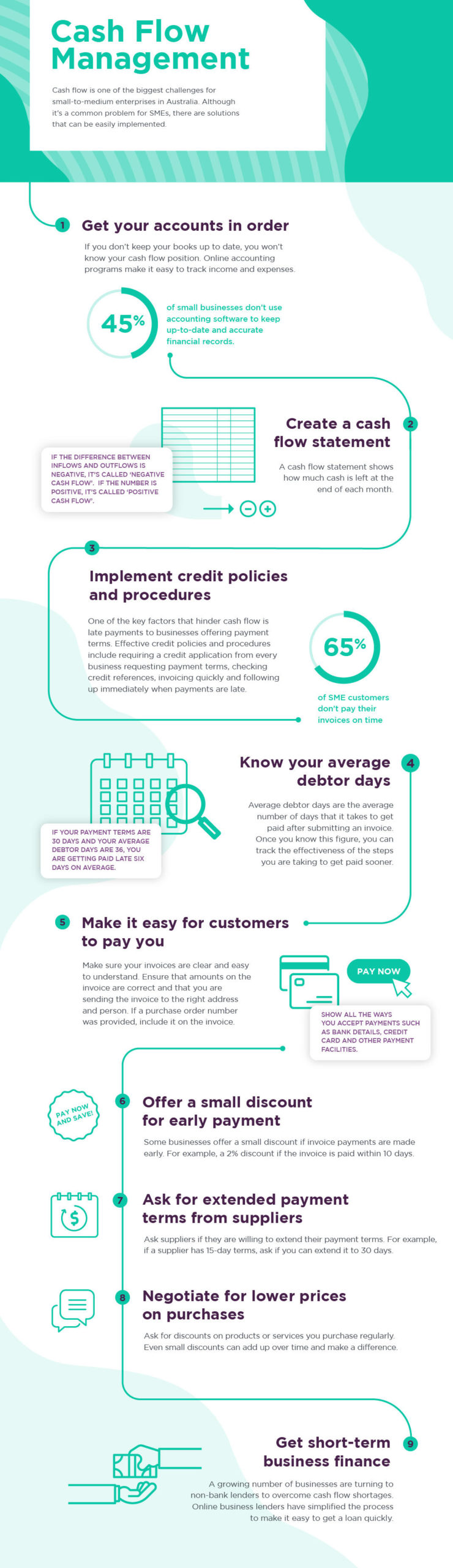

Also, see this helpful infographic on cash flow management from Moula.