If you create a list of the areas you should prioritise in your business, keeping your financial statements accurate is one of the items that should be near the top. A 2022 report from Fundsquire showed that one of the significant reasons why Australian small businesses fail is because they run out of cash – something you can prevent if you keep on top of your finances.

Ensuring that your numbers are accurate will help you make better decisions, create efficient strategies, mitigate failures (like running out of cash), and plan for the future. Now the question is, how do you do it?

In this article, I’ll share with you the steps to clean up your financial data and take control of it. But before that, let’s examine messy and clean data differences.

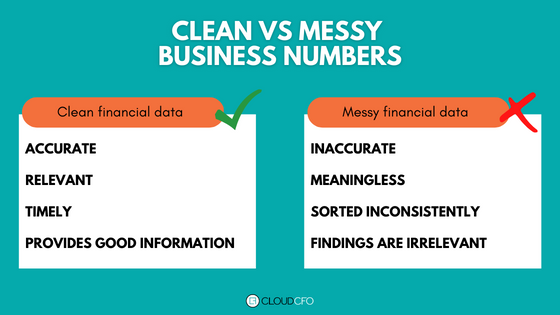

Clean vs Messy Financial Data

Ever looked at your numbers and felt that something doesn’t add up? There’s a big chance that you’re dealing with messy data. While you can always go back and fix errors, you want to avoid being caught up in the middle of reporting to your key stakeholders only to realise that there has been a significant mistake in your numbers.

You can think of messy financial data as a silent killer that can cause your business to crash if you don’t catch it early. For you to know if your business numbers are getting out of order, here is what clean and messy financial data look like.

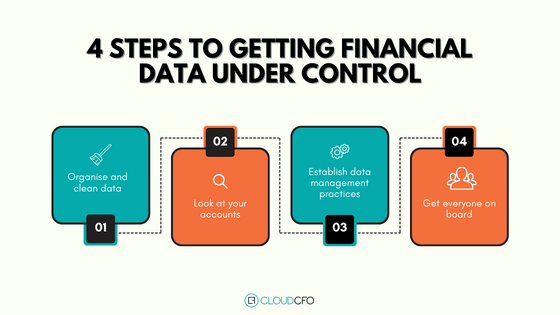

Getting Your Messy Financial Data Under Control

Cleaning your messy data is critical; however, more is needed. To ensure that your business remains stable, you must manage your data continuously. To help, follow these steps to allow you to gain control of your numbers with the ultimate goal of generating true and accurate financial statements.

Step 1: Organise and Clean Data

The first step to managing your data is to look at your numbers and approach them methodically so you can efficiently remove the mess.

Review your balance sheet and profit and loss statement, run through each account and reconcile the information. As you reconcile your accounts, you can identify which transactions are incorrect. Make sure you fix those transactions before completing your reconciliation process – this immediately helps weed out mistakes in your reports.

If you have unreconciled transactions, look at them and identify where they belong – are these duplicate transactions, or are they incorrectly entered in your accounts?

Step 2: Look at your accounts

The next thing to do is to look at the structure of your accounts; determine if you have too few or too many. Are there accounts you can remove or merge? Doing this will simplify things as you will only be moving data in essential accounts. This will help clean your books and make controlling your numbers easier.

Step 3: Establish data management practices

Getting your financial data under control isn’t a one-time deal – it should be a continuous process. When you’re left with clean financial reports, the next challenge is keeping it that way; you can do that by establishing data management practices.

I suggest creating your processes around consistency, accuracy, and timeliness. Make sure that each task in your data management workflow is consistently done using the same rules or logic each time. You should ensure that entries are free of errors and are reconciled in the proper time frame.

Step 4: Get Everyone on Board

If you have an accountant or a bookkeeper working for you, you need to ensure that your team (and yourself included) are willing to sustain clean financial reports, following the processes you have set in place.

You can also utilise tools to automate your process, and it’s also a good practice to schedule reviews regularly so that your financial data will remain organised.

TAKE CONTROL OF YOUR NUMBERS TODAY

If it seems like your financial data is in bad shape, stop ignoring the problem and do something about it. Messy numbers are unacceptable for your business and will deter its success.

Begin by looking at your numbers, systematically organising your accounts, establishing sustainable data management practices, and committing to keeping your financial reports in control.

Clean financial data will reveal the accurate picture and show you where you are now and what you’ve done so you can plan for the future.

If you need assistance getting your numbers in order, don’t hesitate to reach out to us.